A Comprehensive 409 A Safe Harbor Guide

Explore the importance of 409A safe harbor for companies here. Learn more about compliance, qualifying conditions, and consequences of non-compliance.

Fair Market Value (FMV) defines the standard price that a company's stocks or assets would command in the open market under ideal circumstances. Most enterprises use this value to determine the optimal price at which ESOPs (Employee Stock Ownership Plans) must be granted to current or prospective employees.

This blog covers what FMV means for stock, why businesses need to use 409A Valuation to determine the fair value of stock and its impact on private companies. So let’s begin!

FMV, in a general sense, refers to a reasonable and fair estimate of the potential market price of a product, service, or asset. When it comes to stock options, the fair market value represents the price for shares of a company’s stock that a willing seller and a willing buyer would agree upon.

The underlying condition here is that neither party is compelled to complete the transaction. This valuation follows the arm’s length principle to ensure that the transaction happens between unrelated parties acting in their own best interests.

If your company is publicly traded, determining the FMV is simple. Public markets provide present value for different openly traded stocks based on current supply and demand. While the market value for a stock is not the same as the FMV, it can still be a good indicator of the approximate sale or purchase price.

However, as a private company, you do not have this option, as there is no public market that can readily determine the value of your stock. In such a situation, you must opt for a 409A valuation conducted by a third-party appraiser to determine the fair market value of your company's stock.

This valuation is crucial to ensure compliance with IRS regulations and to avoid potential tax penalties. It also protects the interests of your employees by accurately pricing the stock options.

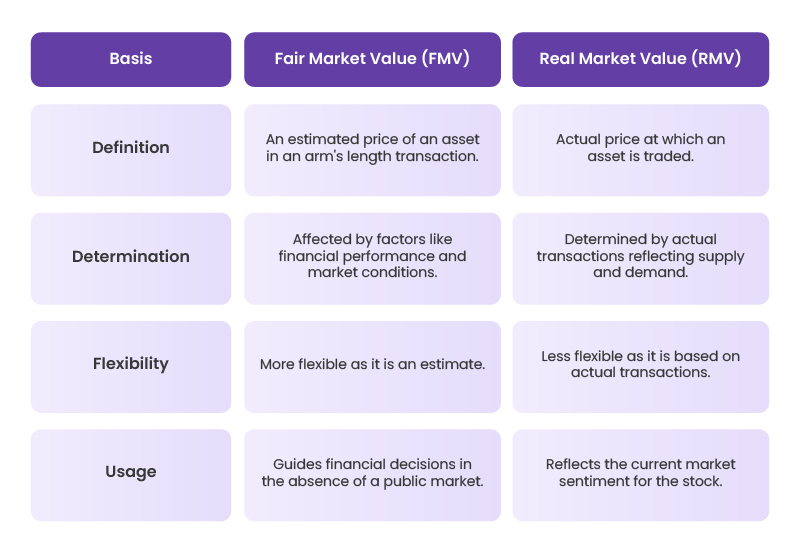

FMV of a company’s stock is the estimated price it would fetch in a perfect market, assuming both buyer and seller are informed and not under pressure. On the other hand, Real Market Value (RMV) is the actual sale price for the stock based on current market conditions and investor sentiment.

While FMV is essentially a theoretical fair value under ideal conditions, RMV is a practical value and is often used in transactions. These two values can sometimes align, but they are likely to diverge based on outside factors such as market conditions, economic factors, and specific supply and demand conditions.

The concept of FMV becomes particularly important when the need to issue stock options to employees and contractors arises. Employee stock options grant recipients the right to buy a specific number of shares in the company at a fixed price (strike price) within a set period.

The Internal Revenue Service (IRS) rules specify that the strike price cannot be lower than the FMV established through a qualified valuation. This ensures fairness for both your company and the option recipient. It also prevents the undervaluation of your company's stocks, protects your company's interests, and ensures that the option recipients are not overpaying for the stocks.

Understanding and accurately determining the FMV is crucial when issuing stock options. It helps maintain compliance with tax regulations specified under the Internal Revenue Code (IRC) Section 409A.

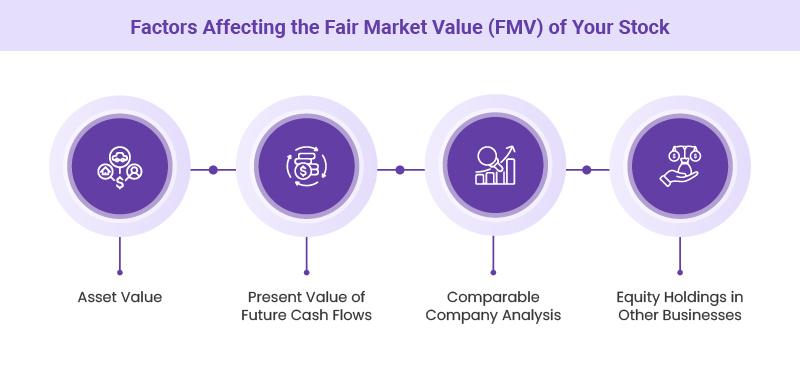

Here are the key elements that have a direct impact on the fair market value of a private company’s stock:

It is the total value of all the resources owned by your company. This includes tangible assets like property, machinery, and inventory, along with intangible assets like patents, trademarks, and goodwill. A higher asset value usually ensures a higher FMV for your enterprise.

This is the present value of your company's expected future earnings. It involves forecasting your company's cash flows and discounting them to the present value using an appropriate discount rate. If your company's future cash flows are expected to be strong, it will ensure a higher FMV for your stock.

This method involves comparing your company to similar businesses in the market to arrive at a realistic valuation. Factors such as revenue, profit margins, growth rates, and risk are considered in this analysis. If your company performs well compared to similar businesses, this will positively affect the FMV.

If your enterprise holds ownership stakes in other businesses, the value of these investments can also affect your company's fair market value. If these corporations are successful, the value of your equity holdings will grow and increase the FMV.

One of the IRS-approved methods to determine fair market value is the 409A Valuation conducted by a professional third-party appraiser like Qapita. Regular 409A Valuations help maintain compliance with tax regulations and ensure fairness in stock option grants.

This valuation is usually conducted on a yearly basis. However, it is also necessary to conduct 409A Valuation after any significant event that could affect the company's valuation. These material events could include funding rounds, mergers, or major changes in company structure or market conditions.

Here are the methods that an appraiser can follow for a 409A valuation:

This method focuses on the present value of the company's expected future cash flows. It is based on the idea that a company's value lies in its ability to generate wealth in the future.

Here, the company is compared to similar businesses in the market. Important factors like revenue, profit margins, growth rates, and risk are considered in this analysis.

This valuation methodology considers the company's total asset value, including both tangible and intangible assets, to determine the FMV of its stock.

Have more questions? Get all the answers about 409A Valuation in our article.

The FMV of a company’s stock must comply with the guidelines specified in Section 409A of the IRC. When it comes to the fair market value for tax purposes, the IRS closely monitors the 409A valuation process, and any discrepancy in the appraisal report can invite scrutiny.

If the IRS rejects the valuation, it can have serious consequences. For instance, if the fair market value of the stock options granted to the employees is found to be understated, they might end up owing income tax on the difference between the strike price and the actual FMV.

The IRS provides a safe harbor provision to protect your company and employees from such incidences. If the corporation's FMV is established through a qualified 409A valuation, the IRS is less likely to challenge it. Moreover, as per safe harbor rules, the IRS must provide proof of any objection to the valuation to justify an audit.

An accurate, fair market value of a business also significantly affects investment decisions. Potential investors and acquirers rely on the FMV to assess the accuracy of your company's worth. An overestimated FMV might deter investors, while an underestimated one could result in a loss of potential capital for you.

Navigating the complexities of 409A valuations can be overwhelming. That's where Qapita can help. We offer 409A Valuation services along with a comprehensive suite of equity management solutions designed to simplify the process for founders and startups.

Tailored Valuation Reports: Our team creates meticulous valuation reports specific to your company's needs, ensuring they accurately reflect your startup's fair market value.

Compliance Expertise: We adhere to recognized accounting standards like IGAAP, IFRS, and SFRS, providing peace of mind that your valuations comply with regulations.

Focus on Your Business: With Qapita's user-friendly equity management tools, you can streamline equity administration and focus on growing your startup.

Get in touch with Qapita today and discover how our expert can help you determine the fair market value of your company’s stocks.